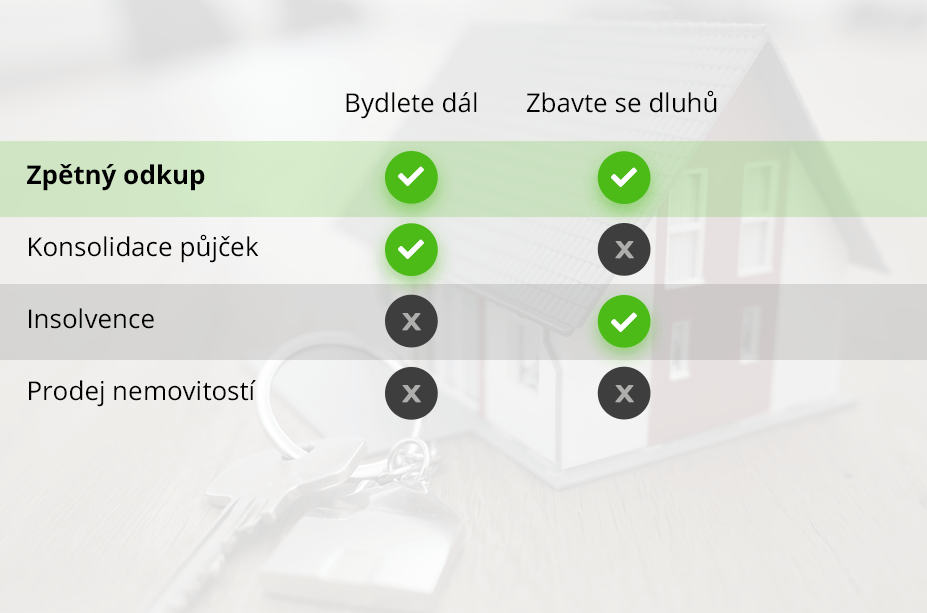

Zpětný odkup nemovitosti je nejrozumnějším způsobem, jak se zbavit dluhů. Na rozdíl od prodeje nemovitosti a insolvence se při něm člověk nemusí bát, že přijde o střechu nad hlavou, a oproti konsolidaci půjček je mnohem účinnější.

Prodej domu formou nájmu

Zpětný leasing nemovitostí

Řešení dluhů zpětným leasingem nemovitosti. Způsob, jak získat peníze, zbavit se dluhů a bydlet dále ve svém.

Jak zpětný leasing nemovitosti funguje?

Klient je zadlužený nebo už dokonce v exekuci. Nemá dostatek peněz na to, aby se z tíživé situace dostal ven. Zároveň mu banka kvůli záznamu v registru dlužníků nepůjčí. Zároveň vlastní nemovitost, která se nachází kdekoliv na území České republiky. Pokud jeho závazky nepřesáhly cenu nemovitosti, může dům nebo byt prodat a ze získaných peněz všechny dluhy uhradit.

My pro něj zprostředkujeme prodej nemovitosti a ze získaných peněz uhradíme všechny jeho dluhy. Klient má možnost ve svém bytě či domě i nadále žít jako nájemník a čerpat případné státní příspěvky na bydlení. Jakmile se jeho situace zlepší, může nemovitost za předem dohodnutou cenu koupit zpět.

Nejnovější články

Dlouhodobá půjčka po insolvenci - ihned, bankovní i nebankovní

Půjčka pro Slováky - s přechodným i dlouhodobým pobytem

Evidence pracovní doby - vzor výkazu ke stažení

Nebankovní konsolidace půjček - pro dlužníky se záznamem v registru

Půjčka pro dlužníky - okamžitě na ruku i na účet

Vše ze světa financí a práce přehledně a srozumitelně.

Bankovní a nebankovní půjčky

Půjčky představují finanční pomoc osobám, které potřebují peníze na zajištění svých individuálních potřeb. Tato kategorie zahrnuje všechna témata související s půjčkami, jako jsou typy půjček, požadavky na způsobilost, výše půjček, úrokové sazby, podmínky splácení a postupy podávání žádostí. Nechybí informace o výhodách a nevýhodách spojených s různými druhy půjček.

Vzory ke stažení

Vzory smluv a dokumentů používaných v obchodním světě. Pro ty, kteří potřebují pomoc s vyhotovením zmíněných písemností, nabízí tato kategorie ukázky nejčastěji používaných typů smluv a dokumentů. Patří mezi ně mimo jiné vzor smlouvy o půjčce, vzor výpovědi z pracovního poměru, vzor životopisu nebo vzor průvodního dopisu. Všechny vzory lze stáhnout zdarma.

Investice

Informace a rady týkající se různých typů investic. Jaké jsou možnosti eliminace rizik při investování? Jak sestavit investiční portfolio? Do čeho investovat a jak své investice diverzifikovat? Vše o investicích a strategiích, které mají investoři k dispozici a které jim pomohou činit informovaná rozhodnutí.

Pojištění

Pojištění poskytuje finanční ochranu proti ztrátám nebo škodám způsobeným neočekávanými událostmi. Tato kategorie je věnována pojištění, které chrání jednotlivce a podniky před takovými událostmi, včetně pojištění automobilů, cestovního pojištění, životního pojištění či úrazového pojištění.

Jak vybrat výhodnou půjčku?

Co sledovat při sjednávání půjčky?

- Podmínky půjčky, úroková sazba, RPSN

- Průběh splácení

- Poplatky a další případné náklady

- Sankce za předčasné, nebo naopak pozdní splacení

- Požadavky na zajištění

- Možnosti refinancování

- Další služby a výhody nabízené poskytovatelem

Jak nenaletět lichvářům a podvodníkům?

- Spolupracovat pouze s institucemi, které jsou známé a mají licenci ČNB

- Důkladně si prověřit poskytovatele před podpisem úvěrové smlouvy

- Sledovat jak výši úrokové sazby, tak výši RPSN (roční procentní sazby nákladů)

- Vyhnout se věřitelům, kteří požadují poplatek předem

- Úvěrovou smlouvu nikdy nepodepisovat pod nátlakem

Co dělat v případě zadlužení?

Vzít si půjčku je velké finanční rozhodnutí a je důležité být při něm opatrný. Před zvažováním půjčky je důležité vzít v úvahu svou současnou a budoucí finanční situaci a také požadovanou výši a typ půjčky. Je také nezbytné řádně posoudit související náklady, jako je úroková sazba a poplatky. Příliš vysoké zadlužení by mohlo mít za následek vyšší náklady a potíže se splácením. Je nutné pečlivě prozkoumat poskytovatele úvěrů, věnovat čas porovnání nabídek a porozumět podmínkám úvěru.

S každou půjčkou je spojeno riziko neschopnosti splácet. Pokud je člověk zadlužený, dluhy nemá z čeho splácet a zároveň vlastní nemovitost, může využít zpětného leasingu nemovitostí. Svůj dům nebo byt jednoduše prodá a své závazky splatí. Bude v něm nadále bydlet jako nájemník a čerpat státní příspěvky na bydlení. Jakmile se jeho finanční situace zlepší, může nemovitost za předem dohodnutou cenu koupit zpět.

Více o zpětném leasingu

Reprezentativní příklad a postup krok za krokem

1.

Klient vyplní nezávazný kontaktní formulář na webu AAApenize.cz.

2.

Počká, až ho telefonicky kontaktujeme, abychom se domluvili se na dalším postupu.

3.

Učiníme mu nabídku zpětného výkupu nemovitosti s nájmem až do výše 70 % její hodnoty.

4.

Uhradíme všechny klientovy dluhy, zatímco on ve svém bytě či domě i nadále bydlí a platí nájem.

5.

Až klient bude moct, koupí nemovitost zpět – za předem dohodnutou cenu.

Co je to výkup se zpětným odkupem?

Zpětný leasing nemovitosti představuje snadný způsob, jak se zbavit dluhů prodejem bydlení bez nutnosti stěhovat se pryč. Zprostředkujeme prodej klientovy nemovitosti a zaplatíme za něj dluhy. On přitom i nadále zůstane ve svém milovaném bytě či domě, pouze začne platit nájem. Jakmile se jeho finanční situace zlepší, může nemovitost koupit zpět, a to za předem stanovených podmínek.

Rozcestník

Půjčky

Kariéra

Vzory